DECARBONISING AFRICA’S GRID ELECTRICITY GENERATION

)

The world faces a climate emergency. The emissions from power plants already operating or commissioned have exhausted the carbon budget compatible with keeping warming to 1.5 degrees. Meanwhile, Africa faces a poverty emergency. The proportion of Africans living in extreme poverty (measured by purchasing power parity of $1.90 per day) is falling but population growth means the absolute number is still rising, and most projections foresee that trend continuing to 2030.

Sub-Saharan Africa (excluding South Africa), home to more than one billion people, is responsible for just 0.6% of cumulative global carbon dioxide emissions, but economic and population growth imply that by 2050, African emissions will not remain immaterial. Almost every African country has joined the effort to achieve net zero carbon emissions by 2050. But global climate agreements also recognise that the imperative of economic development means emissions from less developed countries will rise over the medium term, before falling.

Against the backdrop of these factors, British International Investment recently undertook a review of the technological and cost considerations that will constrain the pace of decarbonisation in centralised electricity grids, alongside Africa’s crucial energy access and economic development goals. This excerpt presents some of the main findings from this review. Our full report – including country case studies and more detailed scenario analysis for decarbonisation strategies - can be found on the British International Investment website.

Introduction

The rapid expansion of reliable and affordable electricity for industry and commerce is essential to the continent’s development. A decent standard of living also requires a far higher level of domestic power consumption than most Africans can access today. Average annual power consumption per person in sub-Saharan Africa (excluding South Africa) is around 500 kilowatt hours (kWh), compared to 6,500kWh in Europe and more in the US.

There are also tremendous opportunities for decentralised approaches to add impetus to the decarbonisation of the overall electricity sector, but our focus here is on the centralised grids that are an indispensable element of electricity provision.

The extraordinary decline in the costs of utility-scale renewable energy sources such as solar photovoltaic (PV) and wind, and energy storage technologies such as batteries, has kindled hopes that African countries can move straight to 100% renewable power. The rapid adoption of renewables will allow Africa to avoid heavy reliance on fossil fuels, but the reality today is that many African countries cannot yet get everything they need from renewables alone. As electricity systems approach 100% fossil-free, batteries and demand management cannot substitute for ‘firm’ clean resources (generation that can be relied upon to produce power as planned), such as gas with carbon capture or reservoir hydro.[1] Moreover, without firm resources, energy storage costs rise increasingly rapidly the closer one gets to designing a reliable grid with zero emissions. As storage technologies advance, the costs of the investments required to facilitate very high variable renewable energy (VRE) penetration will fall, but those African countries without clean firm resources cannot wait.

According to 2020 projections by the International Energy Agency, the average ‘levelised cost of energy’ (LCOE) for utility scale solar PV and onshore wind is now often below gas (average LCOEs being $56/megawatt hour (MWh), $50/MWh and $71/MWh, respectively,) and records fall every year for lower electricity pricing from solar and wind projects.[2] These low LCOEs do not account for the additional system costs that are needed to maintain the supply of reliable power year-round. Integrating high shares of solar and wind VRE requires back-up for when output is low. Low prices per kWh for wind and solar under power purchase agreements (PPAs) also typically require the offtaker to pay for the output generated even when it is not needed, which is not reflected in LCOE calculations. Under alternative contractual arrangements, prices would be higher.

Building a system to reliably match supply with demand, using only VRE requires a combination of overbuilding to raise the floor of output (when the wind does not blow and clouds obscure the sun), meaning too much power is generated in ideal weather, plus storage to shift power from when it is produced to when it is needed. Overbuilding raises the cost of useable power; reducing overbuilding requires more storage, which is also expensive.

The falling costs of VRE and batteries, plus advances in energy storage technologies, promise to raise the limits to VRE grid penetration and reduce the need for gas back-up. But for now, to meet the demand for power 24 hours a day, all year round, the costs for using only VREs and batteries are higher than when some gas is included alongside. For example, as part of our research, we developed scenarios for creating 2GW of fully-dispatchable (i.e. available around the clock) power using different combinations of solar, wind, and gas power, plus battery storage, based on real South African power output data. We found that to create 2GW dispatchable capacity from exclusively renewable sources and batteries required overbuilding to a total of 10.5GW of installed capacity, with a capital cost of between $12 and $17 billion. Allowing 1.2GW of gas power to be built reduced the total capacity requirement to just 5.4GW and the capital cost to between $6 and $8 billion – reductions of ~50% in both capacity and upfront capital cost. Note that in this scenario, the gas capacity was only used at select times during the evening peak demand period – it was not used as baseload power.

In advanced economies, the debate often centres on when renewables and storage will out-compete gas ‘peakers’, which are less fuel efficient but are well suited to rapid ramping to meet demand shifts. In many African countries, the need for reliable power tends to be so great it makes little sense to build a gas plant only to run it 20% of the time. As a result, most gas plants are ‘combined cycle’ gas turbines, that cost more to build and cannot be ramped so quickly, but use fuel more efficiently. A typical tariff for such a plant using indigenous gas and running at 80% capacity would be around 6-8 US cents per kWh. That is 2-3x more than the very cheapest, large-scale, ‘take-or-pay’ solar tariffs, but 2-3x less than what the tariff from a long-discharge solar and storage package would be.[3]

African governments facing the urgent need for more reliable power, multiple demands on their fiscal capacity and a limited desire or ability to pass on higher costs to users, are not likely to deviate far from least-cost technical solutions for the sake of accelerating decarbonisation. We cannot assume the international donor community will bear the costs of more rapid decarbonisation either. One analysis estimates that Africa requires investment of $41 - $55 billion per year to attain the energy access goals of UN SDG 7 without any requirement that all new power be sustainable. Current annual spend is estimated to be in the range of $8 - $12 billion per year[4].

Why the African power sector is different

Africa faces a fundamentally different challenge to decarbonise its electricity grids than wealthier economies with mature energy infrastructure and relatively flat demand. Most African countries are starting from a very low base and must build up their power capacity rapidly to have any chance of achieving their urgent development objectives. Most advanced economies face relatively flat demand (perhaps with some rise driven by e.g., the shift to electric vehicles) and are starting from a position of having sophisticated power systems with a fleet of fossil generation, which they can progressively decommission while adding VREs.

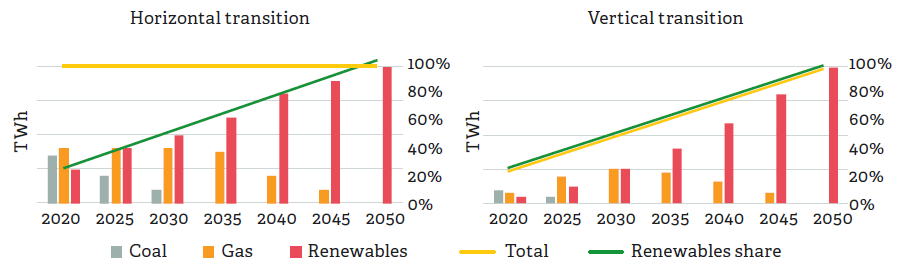

The African energy transition can therefore be thought of as ‘vertical’, because total output must rise rapidly. Mature economies, by contrast, face a ‘horizontal’ energy transition, in which existing ‘firm’ resources can be relied on to handle intermittency from VREs, while alternatives such as energy storage are added over time. Figure 1 is a simplified depiction of the transition to 100% renewables, with a ‘vertical’ transition increasing total power output 4x by 2050, and the ‘horizonal’ keeping it flat. In both cases, coal is decommissioned and the share of VRE in grid generation rises at the same ambitious pace. In the ‘vertical’ case, this requires the addition of some gas generation in the medium term, whereas in the ‘horizonal’ transition all new generation capacity can be renewable.

Figure 1: Stylised depiction of a horizontal (left) versus a vertical (right) grid energy transition. Note the growth in gas power from 2020-2030 in the right graph.

African countries can ‘leapfrog’ fossil fuels and avoid going down the path of high dependence on fossil fuels. They can make far greater use of renewables and energy storage, and more quickly relegate gas to a peripheral role in maintaining grid stability. Decentralised solutions will accelerate this transition. But that does not mean African countries can leapfrog to 100% renewable grids.

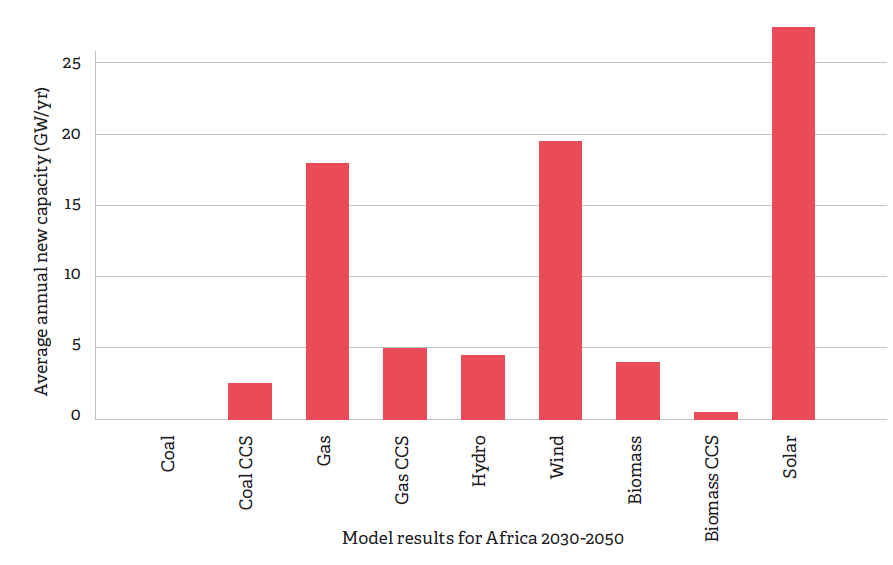

Models of the energy transition in Africa that account for the need to achieve carbon neutrality by mid-century, while rapidly expanding generation for economic development, foresee the need for investments in a mix of generation technologies. Under the most ambitious and stringent climate change control scenario we reviewed, power capacity additions in Africa between 2030 and 2050 are solar (24GW), wind (20GW) and gas (18GW), as shown in Figure 2.[5] Models that allow for Africa to rapidly develop its economy (a several-fold increase in energy production) while respecting a 2-degree target all foresee a mix of VRE and ‘firm’ energy sources because some of these sources are complementary (such as gas and VREs) and also because locations for some vary[6].

Figure 2: Future energy generation additions under the most ambitious climate change mitigation scenario we reviewed

The global carbon budget has little room for new sources of emissions, but if space must be found to accommodate Africa’s economic development need, it should be found from wealthier economies accelerating the decommissioning of their fossil fuel facilities. Even the accelerated decommissioning of a handful of the 5GW coal plants in richer countries would create ample room for African countries to retain their least-cost development pathways.

Accelerating decarbonisation in Africa

The pace of decarbonisation would be hastened by faster reductions in VRE costs, but experts note that higher shares of VRE emerge from models that include progress in technologies to deal with intermittency: making conventional power plants more flexible; creating more regional power pools; adjusting demand; and advances in energy storage. However, if African countries can overcome some longstanding challenges to regional integration, regulatory reliability and inadequate infrastructure investment, grids running almost entirely on renewables should be viable by 2050.[7]

The pace of progress towards this goal will vary across the continent. Our cross-country analysis found that some countries are hoping to achieve levels of VRE penetration as high as 30% by 2030, but progress will depend on the availability of dispatchable power – either hydro, geothermal, biomass or gas – and on the pace of investment in power networks. Transmission and distribution networks remain relatively rudimentary in most African countries, constraining the ability to move low-carbon power from where it is best generated to where it is most needed (including across borders) and to integrate energy storage. Decentralised solutions offer the potential to sidestep these problems, but reliable centralised grids will still be needed by many productive enterprises. The path to fossil-free grids requires operational capabilities that are not yet widely found in the African context.

Advanced grid management capability is critical for integrating high shares of renewable energy. Energy storage is also institutionally and operationally demanding. Regulatory models must reward batteries for charging in periods when renewables output is high relative to demand and discharging when it is low. Even in wealthier countries, suitable regulatory models for integrating energy storage are a work in progress. Rapid improvements to operational capabilities can be made – for example in Senegal, profiled in the full report - but the problems that have beset African utilities for decades may not be quickly overcome.

African countries will not achieve their development aspirations, particularly SDG 1 (end poverty), SDG 7 (universal access to reliable energy) and SDG 8 (decent work and economic development) without a huge expansion in the supply of reliable and affordable grid electricity. African countries should therefore be supported in their efforts to achieve their self-determined, least-cost power sector development plans and future long-term decarbonisation plans.

If the international community wishes to accelerate electricity decarbonisation in Africa, it should support investments that will bring forward the day when new investments in gas generation are no longer needed. Areas for support include regulatory and market reforms, early adoption of energy storage, national and international transmission and distribution infrastructure, and improved power network management capabilities.

[1] Sepulveda, N., Jenkins, J., de Sisternes, F. & Lester, R. (2018), The Role of Firm Low-Carbon Electricity Resources in Deep Decarbonization of Power Generation. Joule, Volume 2, Issue 11.

[2] These LCOE numbers are the medians from a sample of plants worldwide, and there is a lot of variation from place to place.

[3] This range for gas tariffs reflects market data supplied by CDC, which is not public. More details can be found in the full report, Section 3.

[4] van der Zwaan, B., Kober, T., Dalla Longa, F., van der Laan, A., & Kramer, G. J. (2018), An integrated assessment of pathways for low-carbon development in Africa. Energy Policy, 117, 387-395.

[5] From van der Zwaan, B., Kober, T., Dalla Longa, F., van der Laan, A., & Kramer, G. J. (2018), An integrated assessment of pathways for low-carbon development in Africa. Energy Policy, 117, 387-395.

[6] The models also all rely on heavy use of biomass and fossil fuels combined carbon capture and storage, both of which are questionable assumptions.

[7] Schwerhoff, G., & Sy, M. (2019), Developing Africa’s energy mix. Climate Policy, 19(1), 108–124.